I tend to think about giving rather broadly. It includes gifts to family, friends and other individuals I care about as well as formal philanthropy. It is includes how I spend my time as well as my money, how I lend my expertise, and how I leverage my networks.

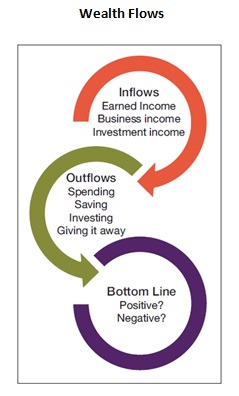

From an economic perspective, I think of giving as one of the dynamics of wealth. If wealth is the accumulation of a pool of assets (my definition), the flows in and out of that pool matter. There are lots of choices, and tradeoffs are involved because, as a friend put it, “One dollar can’t serve two purposes.”

My wife, Fredi, and I have given to and served on the boards of many charities over the years. We have similar beliefs about philanthropy, and respect our sometimes different views on which causes to support. Important point: It’s incredibly important to discuss such things with your spouse.

With all that as a backdrop, I’ll take a stab at briefly answering the 6 W’s of Smart Giving.

- Why do I give?

Giving back is a value that was instilled in me at a young age by my parents and community. Also, I knew I couldn’t change the world but I wanted to serve the needs of society in areas that I found important, and where my contribution could have an impact.

That said, everything doesn’t have to fit neatly into a box. Sometimes I write a check simply because a friend asks me to, or join a board because I know and respect the other people involved. I was a grateful scholarship student at Stanford and HBS, and feel an obligation to pay it forward.

And, finally, there is the sheer joy of it; giving back is one of the most satisfying things I do.

- What do I give?

Time, talent and treasure all have come into play, though in different measures at different times in my life. When I was starting out, for example, I didn’t have much money but I discovered that my real estate expertise was valued by land conservation groups.

During what I call the “go-go years” of peak family and career responsibilities, my wealth was increasing while my time was at a premium. These days, now that I am retired (or so they tell me), I find a significant portion of my time being spent on my philanthropy or helping others with theirs.

- Where do I give?

Some people pick one cause and run with it. As with investing, I prefer a diversified portfolio. I write a lot of checks but my giving patterns are in line with the “importance categories” that we described in Getting to Giving.

A quick analysis of the past several years showed that my top 5 gifts typically represent half of my charitable giving, the next 20 account for 40%, and the last 50 or so add up to only 10%. The causes represented in core and priority categories can change over time, however.

Some of the causes that I care about reflect my heritage, and are quite lasting. My grandfather passed on his passion for land conservation to me, and I am proud that my sons continue the tradition. Others reflect changing circumstances; I didn’t know I cared deeply about cancer until my wife was diagnosed with it.

- Who do I give to?

The intended beneficiaries of my giving vary depending on the cause. Land conservation tends to involve regional issues and groups. I support organizations that enhance quality of life in my community, such as the Boston Ballet. Others have a broader scope; NPR contributes to a healthy and just nation.

Not surprisingly, I do my due diligence on any organization where I am considering making a significant gift. Yes, once again, the four questions: Is it doing work that is important to me? Is it well managed? Will my gift make a difference (but not make it dependent on me)? Will the experience be satisfying?

- How do I give?

I have not chosen to set up a permanent family foundation or tried donor-advised funds. My contributions have been to organizations that I believe in. As I’ve said in previous blogs, I believe in providing multi-year support but favor spend-downs over endowments.

In 1993, I set up a charitable trust. It allows me the luxury of disconnecting giving from tax considerations It’s a smart move for estate planning, I believe, and has proven a useful vehicle for Fredi’s and my giving.

I hasten to add that, unlike some trusts, we actually give away significant portions of it. We are not intending to build a large corpus. We hope that our example will encourage our children and grandchildren to be charitable for whatever causes they choose.

- When do I give?

Some people prefer to wait until they are older (or dead) to make their gifts, figuring that their biggest contribution will be their ability to grow the pot. I was raised to believe that giving is a lifelong responsibility plus I prefer to give now and be personally involved, for impact and fun.

Pension assets are an exception to that philosophy, given our current tax laws. (They would be subject to ordinary income tax and the estate tax, if given to my heirs.) Several big gifts in my estate plan involve pension assets; the charities will get the same amount, and the impact on my kids’ inheritance will be much less.